The Ultimate Guide to Choosing the Best Disposable Lunch Box for Your Needs

Disposable lunch boxes have become an essential item for modern households, offering convenience and hygiene for meals on the go. Whether you're packing lunch for work, school, or a picnic, choosing the right disposable lunch box can make a big difference. This guide covers everything from types and features to buying tips and reliable suppliers.

How to Find Reliable Disposable Lunch Box from China in 2025

China is a leading manufacturer of disposable lunch boxes, offering a wide range of options at competitive prices. To find reliable suppliers, consider platforms like Alibaba, which vet manufacturers for quality and reliability. Look for suppliers with high ratings, positive reviews, and certifications like ISO 9001. Request samples to test the quality before placing bulk orders.

What Buyers Should Know Before Buying Disposable Lunch Box from China

Before purchasing, check the material safety certifications (e.g., FDA-approved for food contact). Be aware of shipping costs and lead times, as these can vary. Also, confirm the supplier's minimum order quantity (MOQ) to ensure it aligns with your needs. Communication is key—ask detailed questions about product specifications and packaging.

Types of Disposable Lunch Box

There are several types of disposable lunch boxes, including:

- Plastic: Lightweight and affordable, but less eco-friendly.

- Paper: Biodegradable and microwave-safe options available.

- Bamboo: Sustainable and sturdy, ideal for eco-conscious buyers.

- Cornstarch: Compostable and biodegradable, perfect for green initiatives.

Functions and Features of Disposable Lunch Box

Modern disposable lunch boxes come with features like leak-proof lids, microwave-safe materials, and compartmentalized designs for meal organization. Some are stackable for easy storage, while others are foldable for portability. Look for BPA-free materials to ensure food safety.

Scenarios of Disposable Lunch Box

These boxes are versatile and suitable for:

- Office lunches

- School meals

- Picnics and outdoor events

- Catering services

- Takeaway food businesses

How to Choose Disposable Lunch Box

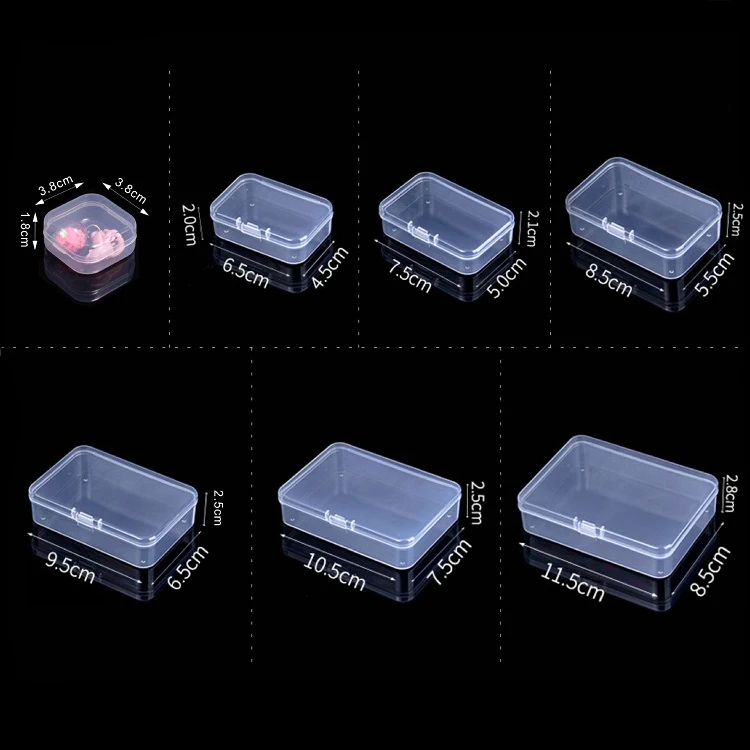

Consider the following factors:

- Material: Choose based on your eco-friendliness and durability needs.

- Size: Ensure it fits your meal portions.

- Lid Type: Snap-on, hinged, or peel-off lids for convenience.

- Price: Balance cost with quality and features.

Disposable Lunch Box Q & A

Q: Are disposable lunch boxes microwave-safe?

A: Some are, especially those made from paper or certain plastics. Always check the label.

Q: How do I dispose of biodegradable lunch boxes?

A: Compost them in a commercial composting facility or check local recycling guidelines.

Q: What’s the average cost per unit?

A: Prices range from $0.10 to $0.50 per unit, depending on material and quantity.

Q: Can I reuse disposable lunch boxes?

A: It’s not recommended, as they’re designed for single use and may degrade.

Q: Where can I buy in bulk?

A: Online platforms like Alibaba or local wholesale suppliers offer bulk purchases.